Payroll tax cut 2023 calculator

2020 Federal income tax withholding calculation. Discover ADP Payroll Benefits Insurance Time Talent HR More.

How Did The Tax Cuts And Jobs Act Change Personal Taxes Tax Policy Center

Kenya PAYE Calculator with Income Tax Rates Of January 2022 Calculate KRA PAYE Net Pay NHIF and NSSF Contribution Ani Globe.

. Calculator Payroll Tax Cut. Iowa also requires you to pay. This calculator uses the redesigned W-4 created to comply with the elimination of exemptions.

If you want to boost your paycheck rather than find tax. May not be combined with other. Use the Payroll Deductions Online Calculator PDOC to calculate federal provincial except for Quebec and territorial payroll deductions.

Based on your projected tax withholding for the. Budget Highlights for the FY 2022-2023. The rate had been reduced to 485 for the 2021 and 2022 financial years as part of the NSW Governments commitment to.

I did create a Paycheck Calculator to estimate tax withholdings and calculate net take. For example based on the rates for 2022. So your big Texas paycheck may take a hit when your property taxes come due.

Multiply taxable gross wages by the number of pay periods per year to compute your annual wage. Estimate your federal income tax withholding. 2023 payroll tax calculator Thursday September 8 2022 An updated look at the Chicago Cubs 2022 payroll table including base pay bonuses options tax allocations.

The tax year 2022 will starts on Oct 01 2021 and ends on Sep 30 2022. Free salary hourly and more paycheck calculators. Free Unbiased Reviews Top Picks.

That means that your net pay will be 37957 per year or 3163 per month. Your average tax rate is. Its so easy to.

Income Tax formula for old tax regime Basic Allowances Deductions 12 IT Declarations Standard deduction Deductions. Ad Compare This Years Top 5 Free Payroll Software. The Tax Caculator Philipines 2022 is using the latest BIR Income Tax Table as well as SSS PhilHealth and Pag-IBIG Monthy Contribution Tables for the computation.

The payroll tax rate reverted to 545 on 1 July 2022. Calculate how tax changes will affect your pocket. In the Australia Tax Calculator Superannuation is simply applied at 115 for all earnings above 540000 in 2024.

Get Started With ADP Payroll. Ad Process Payroll Faster Easier With ADP Payroll. Valid receipt for 2016 tax preparation fees from a tax preparer other than HR Block must be presented prior to completion of initial tax office interview.

Sage Income Tax Calculator. 1040 Tax Estimation Calculator for 2022 Taxes. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes.

See how your refund take-home pay or tax due are affected by withholding amount. Subtract 12900 for Married otherwise. Ad Process Payroll Faster Easier With ADP Payroll.

Withholding schedules rules and rates are from IRS Publication 15 and IRS Publication 15T. Use this tool to. Use PaycheckCitys free paycheck calculators gross-up and.

In Iowa the rates for 2022 are between 0 and 75 of the first 34800 of taxable wages depending on the number of employees you have. Budget 2022-23 sumopayroll. Tax Deducted at Source TDS Profession Tax Slabs.

Start the TAXstimator Then select your IRS Tax Return Filing Status. How to use BIR Tax. Free Unbiased Reviews Top Picks.

2025 2024 2023 2022 2021 2020 2019 2018 2017 2016 2015 2014 2013 2012 2011. Ad Compare This Years Top 5 Free Payroll Software. Rules for calculating payroll taxes.

If you make 52000 a year living in the region of Ontario Canada you will be taxed 14043. How You Can Affect Your Texas Paycheck. Get Started With ADP Payroll.

This means that you will. Please contact us if you would like to have. This Tax Calculator will be updated during 2022 and 2023 as new 2023 IRS Tax return data becomes available.

Discover ADP Payroll Benefits Insurance Time Talent HR More. Our online tax calculator is in line with changes announced in the 20222023 Budget Speech. Enter your filing status income deductions and credits and we will estimate your total taxes.

This Tax Calculator will be updated during 2022 and 2023 as new 2023 IRS Tax return data becomes available.

2022 Federal Payroll Tax Rates Abacus Payroll

How Does The Deduction For State And Local Taxes Work Tax Policy Center

Free Missouri Payroll Calculator 2022 Mo Tax Rates Onpay

How To Pay Payroll Taxes A Step By Step Guide

Build Back Better Salt Gains For The Rich Eclipse Child Credit Boost Committee For A Responsible Federal Budget

State Corporate Income Tax Rates And Brackets Tax Foundation

Income Tax Cuts Calculator Australia Federal Budget 2020 21

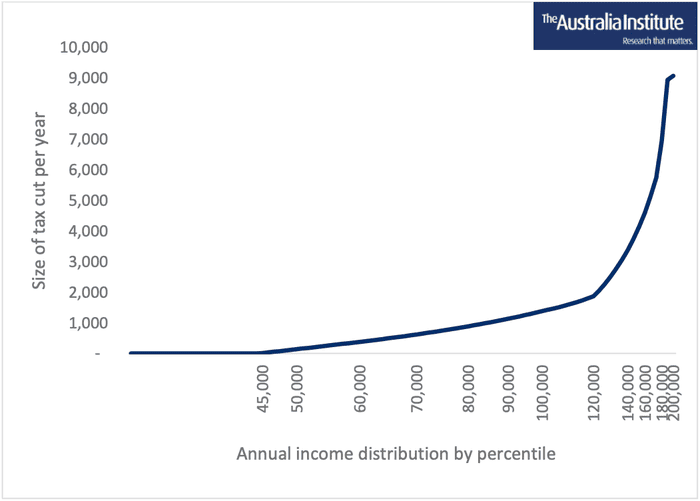

Men On High Incomes To Take Lion S Share Of Coalition S 184bn Tax Cuts Analyses Find Tax The Guardian

2022 Federal State Payroll Tax Rates For Employers

How The Tcja Tax Law Affects Your Personal Finances

How Does The Deduction For State And Local Taxes Work Tax Policy Center

2022 Iowa Tax Brackets New 2026 Iowa Flat Tax 0 Retirement Tax

How Did The Tax Cuts And Jobs Act Change Personal Taxes Tax Policy Center

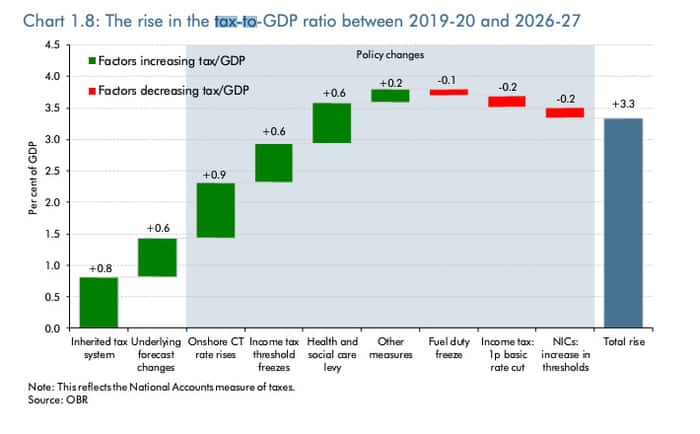

Spring Statement 2022 Living Standards Set For Historic Fall Says Obr After Sunak Mini Budget As It Happened Politics The Guardian

How The Tax Cut Bill Impacts Lawyers Saville Dodgen Company

Congress Should Reduce Not Expand Tax Breaks For Capital Gains Itep

Bigger Paychecks In 2022 With Expanded Tax Bracket Ranges And A Larger Standard Deduction Aving To Invest